- Impersonation fraud has cost UK businesses £32million according to the National Fraud Intelligence Bureau

Barclays has launched a new video to help its business customers stay protected from an increasing type of fraud impacting SMEs – email impersonation.

The video shows how easily the scam can occur, when an imposter poses as an employee’s boss and demands an urgent transfer of money is made. The imposter has done their research on the business and, thanks to social media, knows the boss is on holiday making it a key time to strike. The employee, not knowing the importance of always checking email addresses doesn’t notice the slight difference in the email address, and is placed under time pressure to meet the payment deadline, not realising that the request isn’t genuine.

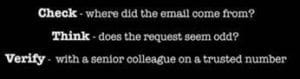

By encouraging businesses to take a moment to check and verify and to think carefully about what they and their employees are putting in the public domain, the bank hopes to help SMEs become more vigilant and better protect themselves from fraud and scams.

Watch video: https://youtu.be/HLiy_nQLJP0

Barclays Business is also hosting regular free cyber-security workshops, led by Barclays Digital Eagles across the country, in a bid to educate SMEs on the types of fraud their business could be vulnerable to, and to learn about how to protect themselves and their employees from cyber-attacks.

Research from Barclays and the IOD last year found that while 9 in 10 (91%) business leaders said that cyber security was important, only around half (57%) had a formal strategy in place to protect themselves and just a fifth (20%) held insurance against an attack.

Adam Rowse, Head of Business Banking at Barclays, said: “Prevention is of upmost importance in putting a stop to this crime – companies need to consider fraud as critical to their business operation as cost or cash flow. We want to help businesses by providing information and guidance to keep their money safe from any attack and to fight back against the fraudsters. With the number of customers going online rapidly rising the issue of fraud prevention has never been more important.”

Top tips for SMEs to keep safe

- Some of the actions that businesses can take to get fraud smart include creating a cyber-security strategy- raise awareness amongst staff of the common cons used to commit cybercrime.

- Keep contact details up to date: ensure your bank has up-to-date mobile/telephone contact numbers for your business, so they can speak to you if they spot unusual or suspicious activity on your account.

- Get up to date security software: make sure your computer systems and any web-enabled phones are protected with up-to-date internet security software.

- Treat all unsolicited emails with caution: don’t click on links or open attachments in emails you weren’t expecting or are not sure about.

- Use strong passwords: passwords should have a mix of letters, numbers and symbols –avoid obvious things like your name, birthday or phone number that others can guess.

- Protect yourself from Invoice fraud – have at least two people authorised to perform signatories for financial payments, to help verification.

- Verify any new supplier payment details you may be sent, if suspicious speak to the supplier directly to confirm they have changed their details, before making a new payment.

More information www.barclays.co.uk/fraudsmart

[su_box title=”About Barclays” style=”noise” box_color=”#336588″][short_info id=’100399′ desc=”true” all=”false”][/su_box]

The opinions expressed in this post belongs to the individual contributors and do not necessarily reflect the views of Information Security Buzz.