Question – What separates a smart businessman from a common criminal? Answer, the breadth of a hair! Consider all those cases we have seen around insider dealing between execrative staff at say, the Bank of England, and the banking sector. Cases of false reporting, and false creative accounting, documenting assets which simply did not exist, and not forgetting Mr Robert Maxwells plundering of the companies ringfenced company retirement fund. In fact, even when we look as high as family members of a US President, we have observed the murky relationships and associated interesting dealings in the Ukraine – it may thus be concluded that the breadth of a hair can be a very fine measurement when it comes to good and bad bedfellows!

As we move forward into the Digital Age, driven by the associated growth of the Metaverse, we will see the associated growth of a financially tokenised digitised world – a world which will be by inference dependent of Blockchains, cryptocurrency, and other representative financial instruments such as the NFT (Non-Fungible Token) – a world which will be a digitised slush fund of multi-billions of intangible assets!

I like many readers have a number of bank accounts in the conventional profile of high street banking which enjoy the underpin of the FSA – and again, I, like a smaller number of readers also trad on, and utilise the Crypto Exchanges of cryptocurrency in the form of Bitcoin (BTC), Ethereum (ETH), and other Altcoins in the sub-multiples of markets and exchanges – and of course, here I (we) run a number of additional risks such as losing the crypto through a hack, mistake when transacting, or by encountering the risk of the breadth of hair!

Of course, we may apply some obvious mitigations to reduce our exposures in the form of say, use 2FA, employ a Cold Wallet (offline), as opposed to a Hot Wallet (on-line) to secure our assets. Or, to impose a level of self-User Education to ensure we check before send, and to confirm the transaction is correct prior to hitting that send key. However, when it comes to my hair risk, that is a completely different matter.

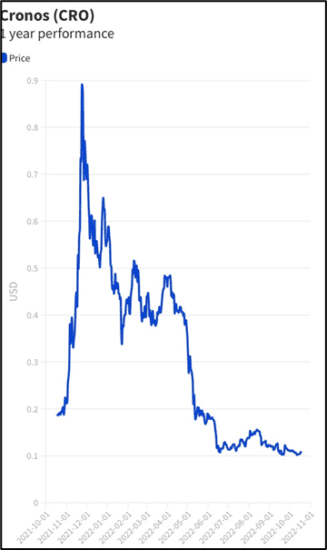

For the millions who watched the world cup, they may have noticed around the pitch the banner adds were running, one of which was Crypto.com The Singapore based Crypto.com company which was once considered a trusted exchange who had minted to marketed their own cryptocurrency under the banner of Cronos (CRO) – See Fig 1, a crypto currency which is now in free fall to one of its lowest levels yet – and whist the company were paying for the expensive adds around the various fields of play, at the same time they were also laying off as many as 2000 employees, slashing market spend, with many other red flags showing which should be considered, if you are considering associating with this Exchange!

Fig 1 – CRO Performance

Then, consider the collapse of the FTX Exchange who filed for bankruptcy 11 November 2022 after the company CEO Bankman-Fried (maybe in hindsight, with a name like that you should be worried) admitted that they had run ran short on funds, and were unable to pay out, or maybe even look to the murk seeping out in the case of Bulgaria, Dubai registered fraudulent cryptocurrency scheme of OneCoin Ltd!

The word of the day must be, don’t be put off by the murky presence of the hair factor, as cryptocurrency will survive, and still does in my opinion represent a great way to trade in the new age world of digital currency – however, take care and prior to converting your hard-earned cash into the world of tokenisation, ensure you don’t get taken in the expensive banner adds running around a World Cup pitch. Do your homework and engage with a company who have, as far as one can tell, a robust presence and reputation – and when you have taken those first steps, spend some time on securing your assets from the common market-garden passer by hacker!

The opinions expressed in this post belongs to the individual contributors and do not necessarily reflect the views of Information Security Buzz.